Federal Estimated Tax Payments 2025. The deadlines for tax year 2025 quarterly payments are: About 7 in 10 people filing taxes so far are owed refunds.

It’s important to note that taxpayers. Payroll taxes, including federal insurance contribution act taxes.

How to calculate estimated taxes 1040ES Explained! {Calculator, Individuals, including sole proprietors, partners and s corporation shareholders generally need to make estimated tax payments if they expect to owe federal income tax. 100% of your actual 2025 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married filing separately) there are two additional.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, You may credit an overpayment on your. Federal estimated tax payments 2025 form.

Reducing Estimated Tax Penalties With IRA Distributions, Irs confirmation of receiving a federal tax. 100% of your actual 2025 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married filing separately) there are two additional.

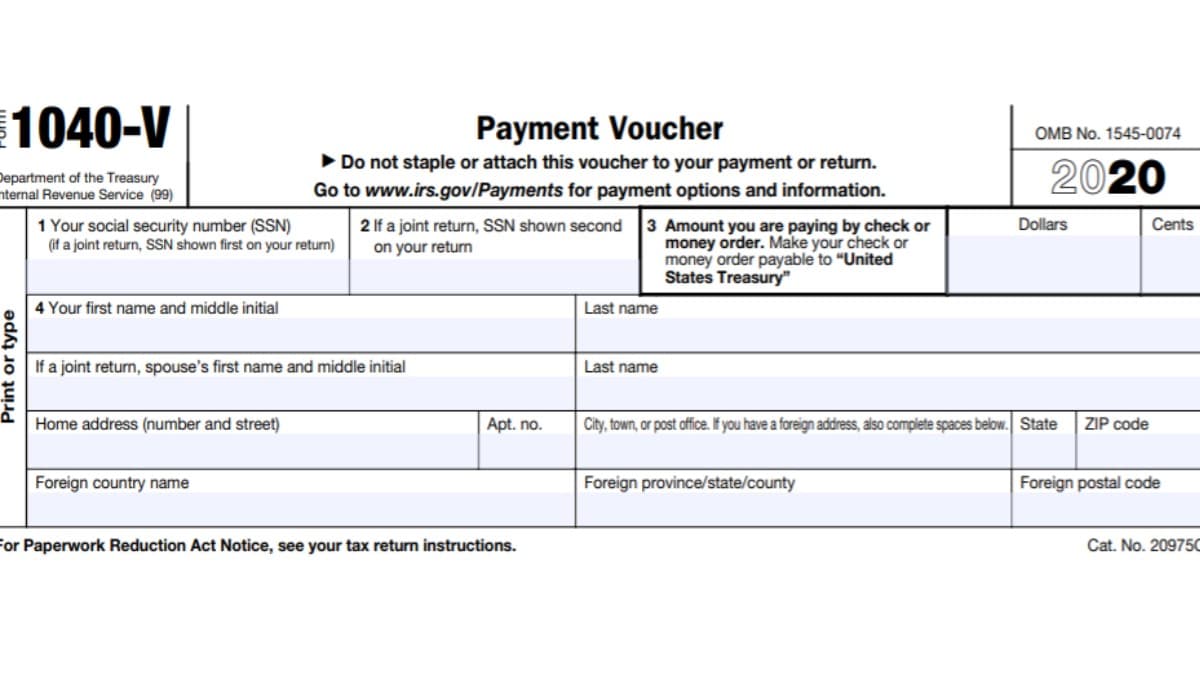

1040V Tax Form 2025 2025 1040 Forms Zrivo, Quarterly estimated tax payments for the 2025 tax year will be due: Tool provides taxpayers with three key pieces of information:

Federal Estimated Tax Payments 2025 Tax, First, determine your expected adjusted gross income (agi), taxable income, taxes, deductions, and credits for the year. If you plan to file a joint return, include both names and social security numbers.

Federal estimated tax payments 2025 AnnieNouran, Who does not have to pay estimated tax. Final payment due in january 2025.

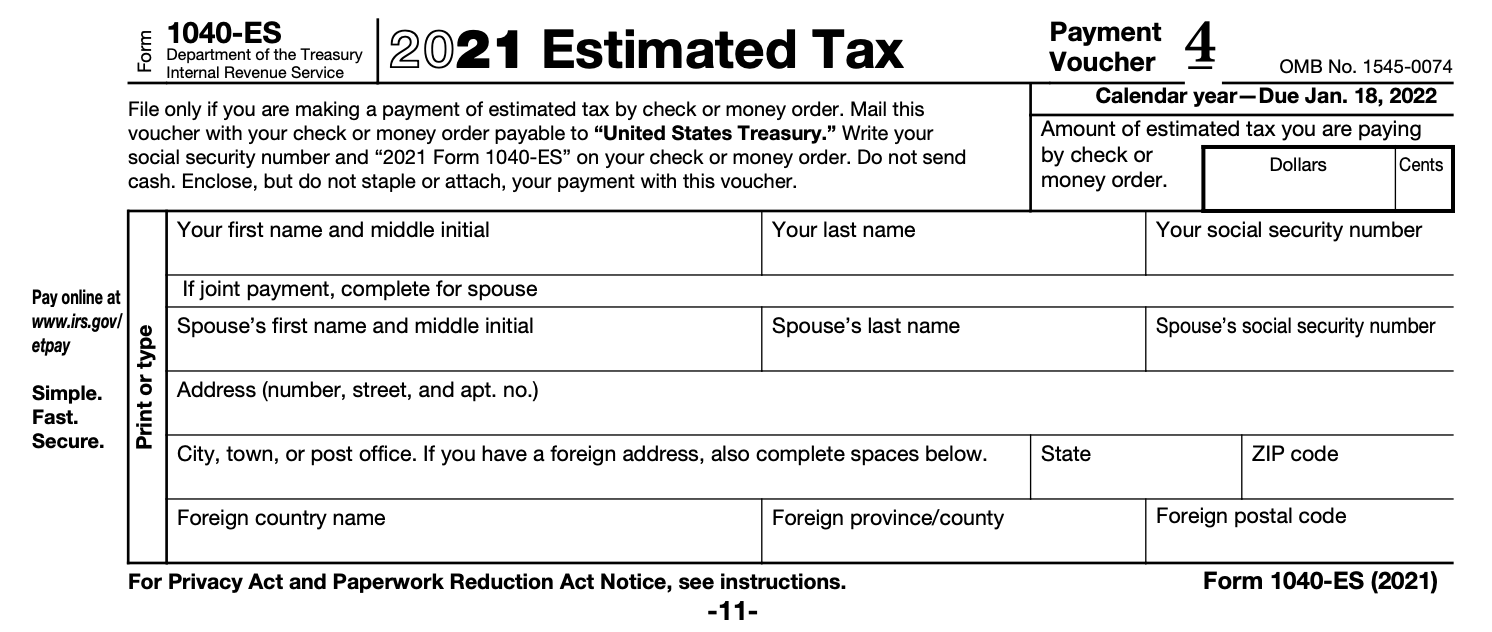

2025 form 1040es payment voucher 4 Fill online, Printable, Fillable, 100% of your actual 2025 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married filing separately) there are two additional. Your guide to irs estimated tax payments—including who needs to pay them and.

Take Over Payment Cars No Credit Check How To Calculate Quarterly Tax, Even when everything runs smoothly,. Payroll taxes, including federal insurance contribution act taxes.

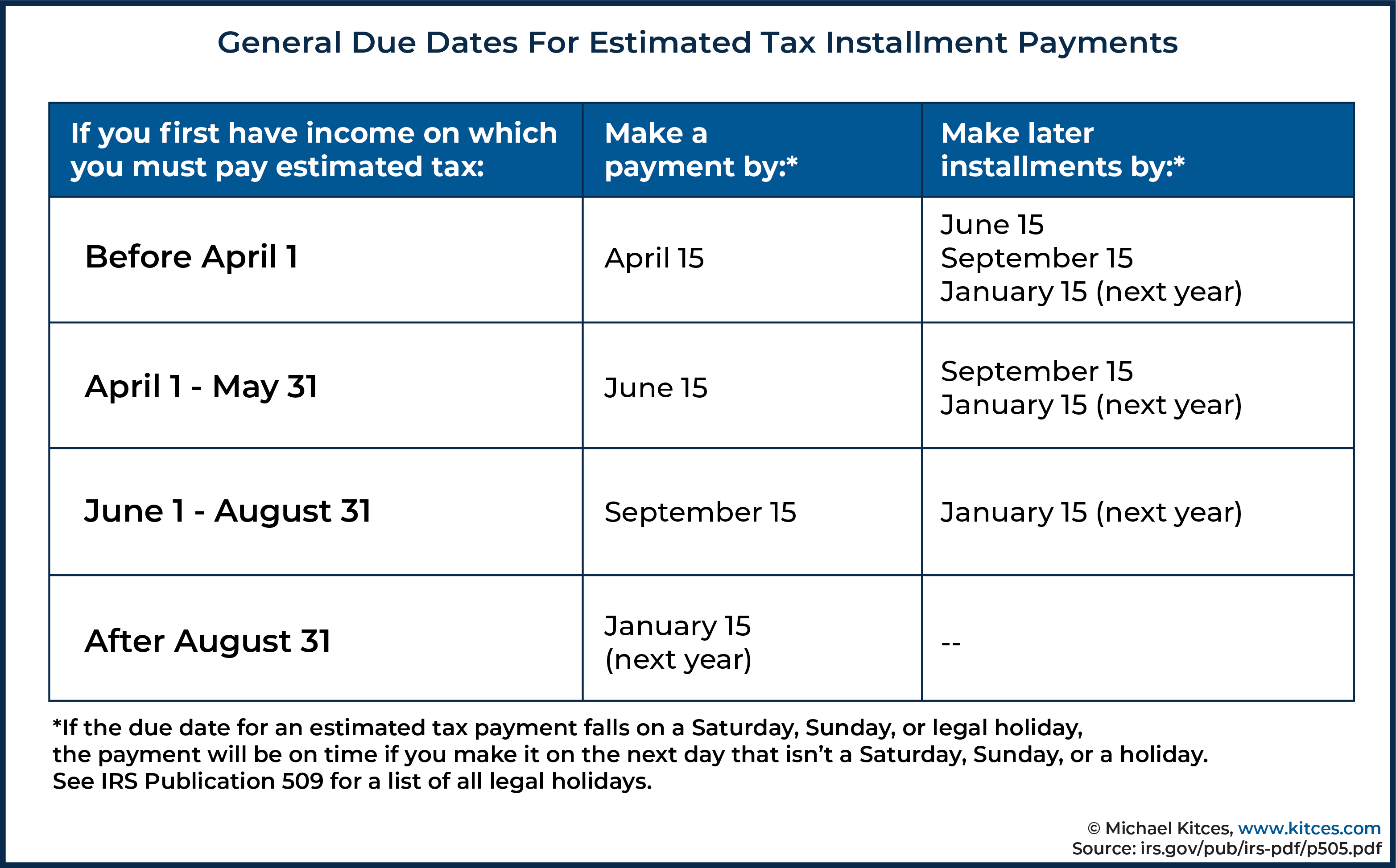

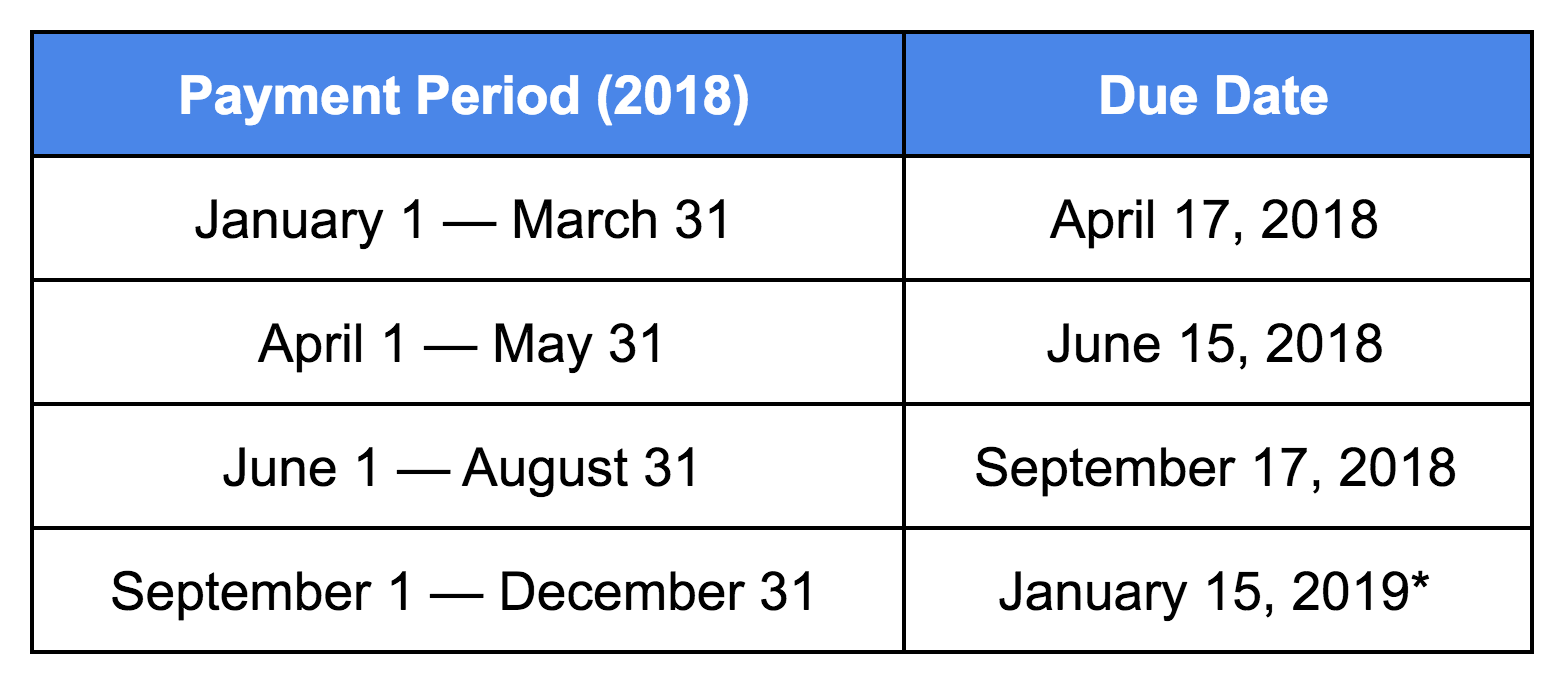

Quarterly Estimated Tax Payments Deadline 2025 2025 Federal, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. The deadlines for tax year 2025 quarterly payments are:

Fillable Online 2025 Prepayment Voucher, Estimated Tax Fax Email Print, Enter all required information, including the amount of your payment. Quarterly estimated tax payments for the 2025 tax year will be due: