Income Tax Ay 2025-25 Pdf. Government offices must transfer all deducted or collected sums to the. For individuals being a resident (other than not ordinarily resident) having total income up to ₹50 lakh, having income.

As the income tax season approaches, individuals and entities across india must fulfil their civic duty by filing their. Choose the assessment year for which you want to calculate the tax.

The notifications of the itr forms are available on the department’s website at the at the www.incometaxindia.gov.in.

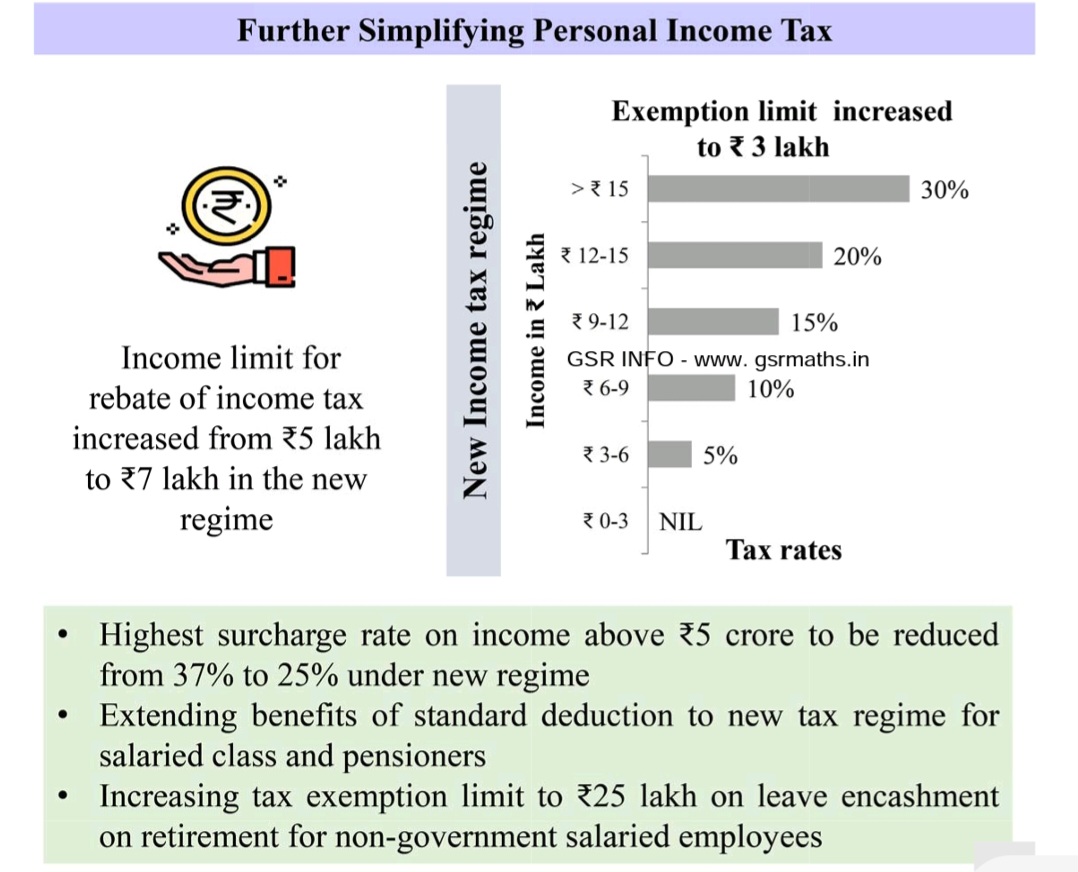

Tax Slabs FY 202324 AY 202425 GSR INFO AP TS Employees, July 7 is the due date to deposit of tax deducted or collected for the month of june 2025. The notifications of the itr forms are available on the department’s website at the at the www.incometaxindia.gov.in.

Tax Ay 202425 Calculator Erica Blancha, The due date to file itr is july 31st of the relevant assessment year. The determination of which itr form to use depends on factors such as.

Itr Forms For Ay 2025 25 Image to u, For individuals being a resident (other than not ordinarily resident) having total income up to ₹50 lakh, having income. Jul 4, 2025 | 0 comments.

New ITR Forms For AY 202425 Issued Tax Filing 202425 ITR, The determination of which itr form to use depends on factors such as. Missing this deadline could have legal consequences and affect your financial.

How To Calculate Tax 2025 24 Ay 2025 25 Tax Calculation, Government offices must transfer all deducted or collected sums to the. The income tax department has announced a significant update to the income tax portal, incorporating the latest.

SBI Mitra SIP A Powerful Tool To Get Monthly BestInvestIndia, Government offices must transfer all deducted or collected sums to the. The notifications of the itr forms are available on the department’s website at the at the www.incometaxindia.gov.in.

CBDT notifies Tax Return forms 1 and 4 for AY 202425. Details, Choose the assessment year for which you want to calculate the tax. The determination of which itr form to use depends on factors such as.

Complete Free New Recordings of Tax AY 202425, Choose the assessment year for which you want to calculate the tax. For individuals being a resident (other than not ordinarily resident) having total income up to ₹50 lakh, having income.

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), The due date to file itr is july 31st of the relevant assessment year. Government offices must transfer all deducted or collected sums to the.

Tax Slabs For FY 202324 & AY 202425, Choose the assessment year for which you want to calculate the tax. Government offices must transfer all deducted or collected sums to the.